Introduction:

As a home buyer in Arizona, you will hear the term “escrow account” during the purchasing process. While escrow accounts might seem a bit confusing at first, they play a crucial role in ensuring a smooth transaction. In this blog post, I will explain what escrow accounts are and how they impact your monthly payments.

What is an Escrow Account?

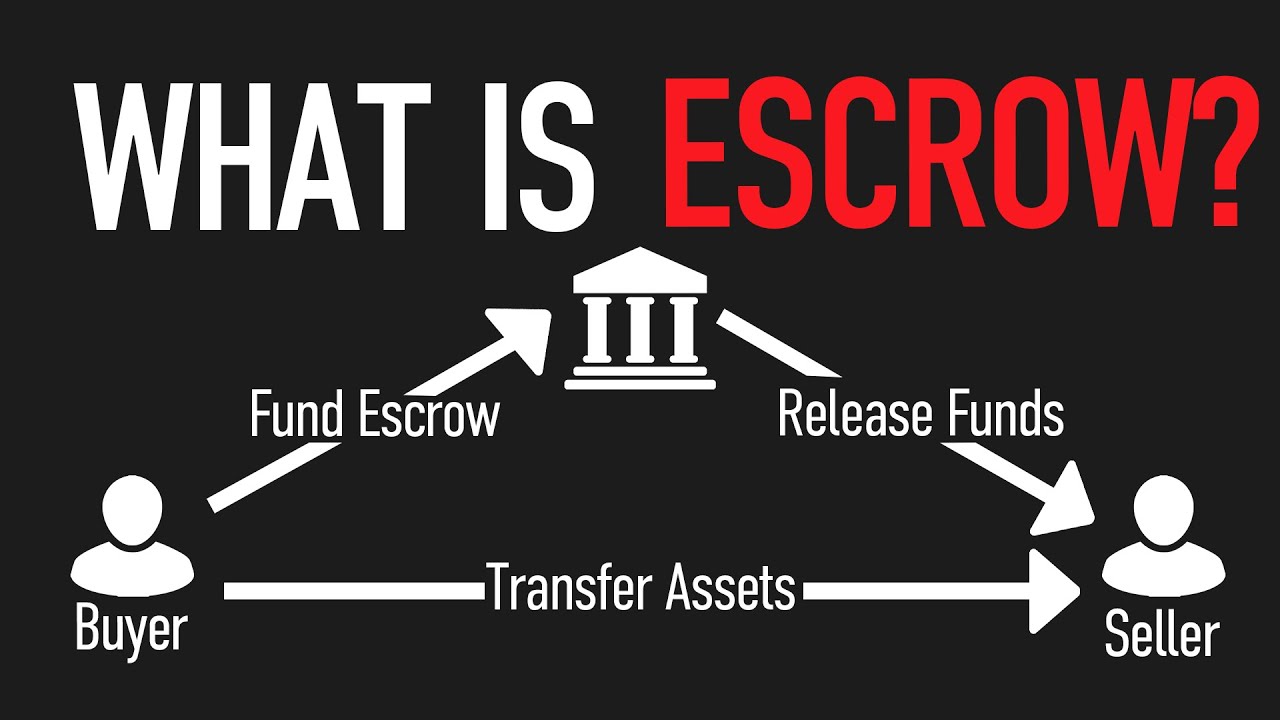

An escrow account is a financial arrangement where a neutral third party holds funds on behalf of the buyer and seller during a real estate transaction. The funds in the account are typically used to pay for property taxes, homeowners insurance, and other related expenses.

Monthly Payment Components:

When you buy a home, your monthly mortgage payment consists of several components, including principal, interest, taxes, and insurance. Let’s review each component:

Principal: This is the amount you borrow to purchase the home. Each monthly payment you make contributes to reducing the principal balance over time.

Interest: Lenders charge interest on the amount you borrow as a cost of borrowing money. The interest portion of your monthly payment decreases as you pay down the principal.

Taxes: Property taxes are levied by the local government based on the assessed value of your property. These taxes fund local services such as schools, infrastructure, and public safety. Rather than paying the entire tax bill upfront, your lender may collect a portion of the annual taxes each month, which is deposited into the escrow account. Remember that the taxes on the house may increase on an annual basis. Review the tax history it is available on the county tax assessor’s website.

Insurance: Homeowners’ insurance protects your property and belongings in case of damage or theft. Similar to property taxes, your lender may require you to pay a portion of your annual insurance premium each month into the escrow account. Remember to shop around for your homeowner’s insurance. Sometimes you get a discount if you combine your insurance policies. Such as your home, auto, and life insurance.

The Role of the Escrow Account:

The escrow account acts as a central hub for these expenses. Instead of paying taxes and insurance directly, your lender collects a portion of these costs along with your mortgage payment, which is deposited into the escrow account. When the bills are due, the funds are disbursed from the account to the appropriate entities on your behalf.

Advantages of an Escrow Account:

Simplicity: By bundling these expenses into your monthly payment, an escrow account simplifies your financial obligations.

Budgeting: Knowing that your taxes and insurance are paid through escrow helps you budget more effectively, as these costs are spread out over the year.

Avoiding Penalties: Escrow accounts ensure that your tax and insurance bills are paid on time, preventing penalties or late fees that could result from missed payments.

Conclusion:

Ultimately, your understanding of how escrow accounts and monthly payments work is crucial for you as a home buyer. By consolidating property taxes and insurance into your mortgage payment, escrow accounts simplify your financial responsibilities and help you budget effectively. If you have any further questions about escrow accounts or the home-buying process, don’t hesitate to reach out to me at 480-340-2808